Charlie Munger And What Makes A Good Investor

A devoted philanthropist, a dedicated and highly disciplined investor, and a down-to-earth reclusive billionaire are possibly the most uncommon adjectives put together to describe one of the world’s billionaires – especially in today’s flashy ‘Insta-era’. Charles Munger, the Vice Chairman of Berkshire Hathaway is one of the world’s wealthiest businessmen, sans the social media displays of wealth and power.

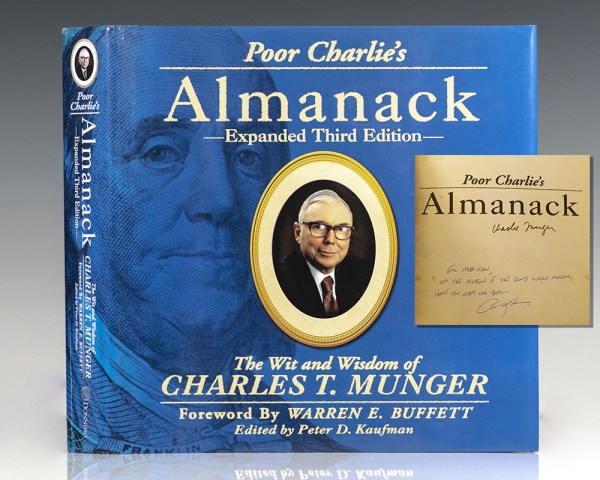

Poor Charlie’s Alamanck (2005), by Peter D. Kaufman, is a window into Munger’s investment philosophies, that have gained the company millions of dollars. Additionally, his inspiring ‘etiquettes’ towards keeping numbers honest, sticking to principles, a deep belief and trust in Wall Street, and his dedication to paying taxes rather than having money in tax havens, is proof of how his principles are not just about doing the right thing, but also about how they are actually good for business.

A Strong Work Ethic And Philanthropy

Munger, as a youth, worked in a grocery store that was run by Warren Buffet’s grandfather. With a 12-hour, no-breaks shift, he would earn $2. However, it was this gruelling experience that instilled in him a work ethic that stuck with him through the journey of his career from a grocery stacker to a billionaire.

His single-minded focus on his work and his ability to tune out distractions (albeit having 8 children at home) is fondly remembered by his children even today. In fact, his son William Borthwick remembers how his father worked hard to instil his work ethic in his children.

Borthwick remembers the time when his job was to drive into town, to pick up the housekeeper and collect the newspaper. The journey involved taking a short boat ride and then driving into town. One stormy day, Borthwick, focussing on the weather, forgot the newspaper. Munger sent him back out in the storm to get it! This lesson in getting a job done right the first time, though harsh, was effective, teaching Borthwick to do his work effectively at the outset.

Munger was a strict father, yes, but his dedication to caring for his children, and his commitment to their education and careers, have left them with fond memories.

Growing up during the Great Depression, Munger was a first-hand witness to poverty. His experiences as a child instilled a need to help others around him. Along with his wife Nancy, Munger has made valuable contributions to hospitals and universities, supported a number of causes like Planned Parenthood. Munger believes that as it is important to work hard, it is equally important to give back.

An Unconventional Academic Career

Munger sought knowledge wherever and whenever he could. As a child, his parents always encouraged reading. As a teen, Munger would spend hours in the library of a doctor family friend, where he would immerse himself in medical journals. Thus began his fascination with medicine and science.

In college, he decided to pursue mathematics and later physics at the University of Michigan. Munger believes that his ability to apply logical theory and solve complex problems evolved during this period. However, his education was interrupted by World War II, and after his sophomore year, Munger joined the Army Air Corps. He was sent to the University of New Mexico to study engineering and science to become a pilot. Next, he studied meteorology at the California Institute of Technology.

In 1946, after he was discharged as an officer from the Army Air Corps, his education was a patchwork of sorts. Having studied different subjects in many prestigious institutes, Munger still did not have a degree in anything! At this point in his educational career, Munger, with a little help from a family friend, applied and got through Harvard Law. Munger’s intellect and IQ, and his achievement of the magna cum laude proved that having a bachelor’s degree really didn’t matter!

World War II, albeit a disruption in Munger’s education, was a blessing in disguise. It led Munger down an unconventional path towards independence and original thinking that have been valuable to him through his life!

The Beginnings Of A Career In Investments

After graduating, Munger joined a Californian law firm and thus began his prosperous career, and had founded Munger, Tolles, and Olson, a successful law firm. However, Munger still wanted more. He was restless as he didn’t want to settle for a career in law. He wanted to apply his intellect and skills in other areas too.

In 1959, Munger returned to Omaha to wrap up his father’s estate after his death. Later, he attended a dinner with some family friends, who had also invited Warren Buffet. Buffet, at 29, was passionate about investing and business and was a perfect match for Munger’s intellectual curiosity. They hit it off instantly. What started as a dinner conversation that fateful night, turned into a partnership that has lasted more than half a century!

Warren Buffet managed to convince Munger that his skills would be best used in the fields of investment and finance. Finally, after gradually extricating himself from his firm in 1965, he started his own investment partnership with a law colleague. Munger found success in that venture too. However, he decided that he would rather build his wealth through owning stock in company holdings, than managing funds directly for investors.

He finally joined Buffet at Berkshire Hathaway, making it one of the most respected investment companies in the world. The companies spectacular successes are evidence of Munger’s unique contributions, derived from his training in math, physics and law, to run a tight, scrupulous, and clean business. While Buffet, for his part, keeps Munger on his feet by giving Munger a myriad of intellectual challenges.

Today, well into their nineties, Buffet and Munger are still at the top of the investing game!

Commitment, Principles, And High Ethical Standards

In the world of business, finance, and investing, unethical people and practices are rampant! Wall Street too, has seen its fair share of crooks. Movies like The Wolf Of Wall Street open only a small window into how bad the situation can really get!

On the other hand, there are principled investors like Charlie Munger, and hence companies like Berkshire Hathaway, that believe in and keep their investing practices righteous. Considering Berkshire Hathaway is a mammoth organization of 175,000 employees, it has had very few scandals or litigations, enabling clients to put their trust in the company. Moreover, with strict principles like Munger’s, practices such as insider trading or doctoring books are simply crushed out!

The temptation and pressure are enormous, as investors need to build the trust of clients and show that they can add true value to portfolios. Many even break the law by cutting corners. The frequency of such practices has, in fact, made it a norm, where investors and managers rationalize the practices with excuses. It is the same with tax evasion. In fact, even big conglomerates like Amazon set up headquarters in tax havens such as The British Isles or Dublin to avoid paying taxes.

Munger, however, has no patience for such ‘socially accepted’ ways of law-breaking. He is strict with Berkshire Hathaway employees and shareholders to refrain from grey areas and law-breaking. The company has maintained its reputation where others like Enron have been tainted with scandal.

Despite Munger’s strict vigil, there have, however, been close calls.

Berkshire Hathaway had once invested in a bank, Salomon Brothers. The bank, despite advice and warning from Munger and Buffet, chose to conduct business with the notorious fraud Robert Maxwell. The disastrous allegiance and its repercussions further cemented Munger belief in partnering with those who are aligned with the ethical standards he has.

Munger’s Foresight Saved Berkshire Hathaway Damage

Munger’s belief in ethics is especially notable in the 2008 Global Financial Crisis. Even before the crisis hit, Munger was vocal about ‘creative accounting’ and accountants who fudged clients books. He called it the ‘moral decay of corporate accounting firms’, where principled firms shifted their moral compasses to help clients fudge books to get ‘filthy rich’. He has seen principled companies from his youth lose their ethical standards and find loopholes in the law.

According to Munger, accounting for derivatives is perhaps one of the most unethical practices. It involves creating financial contracts based on a speculated value of an underlying asset. For example, student loans are bundled and sold to investors based on projected values in future, when debtors will pay up, rather than clear, established values of the present. This practice is what makes derivatives risky, especially if the debtors don’t pay, rendering the contracts worthless.

Munger knew the danger that speculation and derivatives posed. He also warned that companies practising it should be prepared for a ‘significant blow-up’. Munger’s words were prescient of the 2008 crisis. When housing prices crashed, debtors were unable to pay off loans, derivatives were rendered worthless, and the market crashed.

Berkshire Hathaway was one of the only companies to emerge unscathed, due to Munger’s strict rules surrounding unethical creative accounting. His resistance to unethical practices proved to be a blessing.

What Makes A Good Investor: Accepting Mistakes

Munger has always had a zero-tolerance policy against liars. Above all, he values honesty the most. At the same time, he has always had a pragmatic view towards mistakes. In fact, one of his favourite stories is about how one of the financial officers in his company made a mistake that cost the company thousands of dollars. As soon as the officer realised his mistake, he headed to the president and owned up.

At that point, while the president agreed that it was costly oversight, he let the officer keep his job because the officer had, rather than a cover-up, owned his mistake. What mattered most was that the officer had learnt from the mistake he made.

Munger believes in practising what he preaches. And true to his belief, he admits to having made a number of errors through his investing career, especially ‘errors of omission’ – failing to buy enough stock or not recognising a valuable investment opportunity. For instance, one of the errors include not investing in Walmart, a decision that cost them over billions of dollars, just because they thought the stocks were too costly then.

Another example of oversight was when Munger and Buffet, both, nearly declined to invest in See’s Company – a high-quality confectionery company – due to its high pricing and did not recognize its value. However, after a colleague made them see the value of quality, they changed their minds. The ‘in-the-nick-of-time’ investment turned out to be a lucrative one, earning them more than $2 billion in profits.

Munger’s ability to change his mind in situations such as these is one of his key assets. In fact, Munger sees ideas like tools. If a new one is more useful, discard the old one. He has the ability to not take it personally when a colleague or employee disagrees with his opinion. Munger demonstrates the fact that only those who are strong and confident are able to own up to their mistakes.

What Makes A Good Investor: Focus And Patience

Charlie Munger believes that patience is one of the most important qualities an investor should have.

Buffet and Munger are, in fact, known to wait patiently for a good opportunity. Once they find it, (for example, undervalued stock in a company they predict will be profitable) they pounce, buying large parts of the company. Once they own shares, they keep those shares, and at times for decades.

Such a ‘wait and watch’ investment style isn’t exciting enough, but has proven to be lucrative time and again. For example, after the 1987 stock crash, they saw an opportunity to acquire Coca-Cola stock at a very good price. Though the market was down and the value of Coca-Cola’s stock value had sunk, they knew that the value would eventually recover due to the solid brand value of the company.

They invested around $1.3 billion, making Berkshire Hathaway the biggest shareholder. Those shares are worth more than 8 billion today, proving that patience and focus pay back big!

Many investment companies apply a strategy called diversification, which involves hedging bets and investing smaller amounts in a wider range of companies. Berkshire Hathaway, however, prefers quality over quantity. They invest in a smaller number of companies and hence are able to hold a majority stake. This gives them more influence over the decision in those companies. Munger also advocates that when one chooses to invest wisely, one need not have a broad portfolio. Ten solid quality companies are better than a mix of a dozen over and under-achievers.

Munger’s investment policy is akin to the proverbial slow tortoise rather than the fast hare. Though it doesn’t look glamourous from the outside, the results speak for themselves.

What Makes A Good Investor: The Ability To Draw On Diverse Mental Models

Let’s consider a workman with only a hammer as a tool to work with. Because of the limited options he has, the workman starts to see bludgeoning as the only possible solution to fix every task or problem he encounters.

Munger often uses this parable to explain the fact that an investor with only one way, or tool, to approach a problem, will suffer in the longer run. He will try to fit every reality to suit his ‘only known’ approach. In order to be successful, one has to have a broad range of tools from different disciplines. Using different approaches give one the mental acuity that is required to adapt ones thinking to different problems.

The problem is that the Harvards’ of the world often train in only one discipline, with different departments of academia fighting for superiority. This is detrimental. However, if one considers how pilots are trained to think out of the box and apply mental agility to different problems encountered in theory and in practical application, all while updating their knowledge base throughout their lives, it becomes evident that applying one school of thought or one manner of problem-solving to everything one encounters is not the route to success.

Pilots are trained to make mental inventory ‘checklists’, of all possible problems that they could encounter and all possible solutions that they could apply. This practice helps pilots in considering counterintuitive possibilities and thus, encourages mental agility.

Similarly, if young investors were to perceive their education in this manner, by constantly applying multidisciplinary knowledge while updating their skills regularly, and conducting mental checklists, they would become more adept at making good judgements and solving complex problems. They would simply be more successful at thinking.

What Makes A Good Investor: Understanding Psychological imitations

A good investor should have sound knowledge of psychology, and above else, a good understanding of the limitations of their own thinking. Humans are sadly, easily manipulated by the subconscious, have blind spots and limited knowledge. It is the reason why advertising works so well!

In order to combat the limitations of one’s own psychology while investing, Munger suggests a ‘two-track analysis’. It involves taking a step back first and then rationally considering all data available. What are the real risks involved? What are the possible benefits of investing?

Next, one has to consider the psychological factors that could be influencing, at a subconscious level, one decision as an investor, that could be leading to conclusions but are actually incorrect. For instance, is the investor drawn to the company because the management is flattering? Or has the investor drawn conclusions about the company based on prejudices or feelings of antipathy, that could lead him to turn down an otherwise sound investment opportunity?

Having an understanding of what one doesn’t know can be a good thing. It can be used to one’s advantage. For instance, Buffet and Munger have a defined ‘circle of competence’ which they use to decide while qualifying an investment. On principle, they do not invest in ‘high-tech industries’ such as internet-based offerings or computers as they do not have much knowledge about them. While this has closed them off to some very lucrative opportunities, it also has saved them from possible huge losses.

One can, of course, broaden one’s circle of competence, however, within reason. Essentially, a person can gain more knowledge about law and specialize in one area. However, if one doesn’t know how to play tennis at all, one cant acquire championship skills very fast. The trick is to understand the difference between the two!

What Makes A Good Investor: Spotting The Crest Of The Wave

The investor Benjamin Graham pioneered the strategy of value investing, wherein he calculated the value of a company if it were to be sold privately he then divided the price by the number of shares available. He would deem investing in the company worthwhile if those shares were on the market for not more than one-fifth of the company’s actual value.

This strategy has been successfully applied by many investors including Berkshire Hathaway. However, such companies are failing often. Munger believes in using another strategy. He finds investing in good companies, rather than looking for companies that have gone bust, far more lucrative.

How then, can one define and spot a good company?

According to Munger, one has to consider several important factors.

- Management

The management of a company is an essential factor to consider, as a good manager can completely turn a company around. For example, Jack Welch had a tough policy for General Electric (GE). He would dictate that if any division of the company wasn’t first or second on whichever market they were in, he would shut it down. This policy was brutal and even controversial, but ambitious and good for the health of the company. Hence, GE was good for investors!

- Product Placing

The second important factor is how the product of the company is placed in the market. Products with strong and established international distribution networks and unparalleled brand recognition like Gillette and Coca-Cola are infallible. Additionally, companies like Gillette that invests in the most cutting-edge tech are able to maintain their competitive edge in the market.

While both, good management and product, are essential to make a sound investment, the best way to make a skyrocketing successful investment is to find a company that is poised for success, at the crest of the wave. A company like Microsoft, at the beginning of the PC boom, was poised for success, had the savvy and skill to capitalize on its positions. Such a company is akin to a surfer’s dream wave!

Conclusion

Charlie Munger’s mantras for investment success have made him the success he is today. He staunchly believes that good investors need to be cool-headed, focus on quality investments rather than quantity, uphold their principles and ethics and guard them with the highest priority, have patience and above all have an understanding of what makes a good investment.